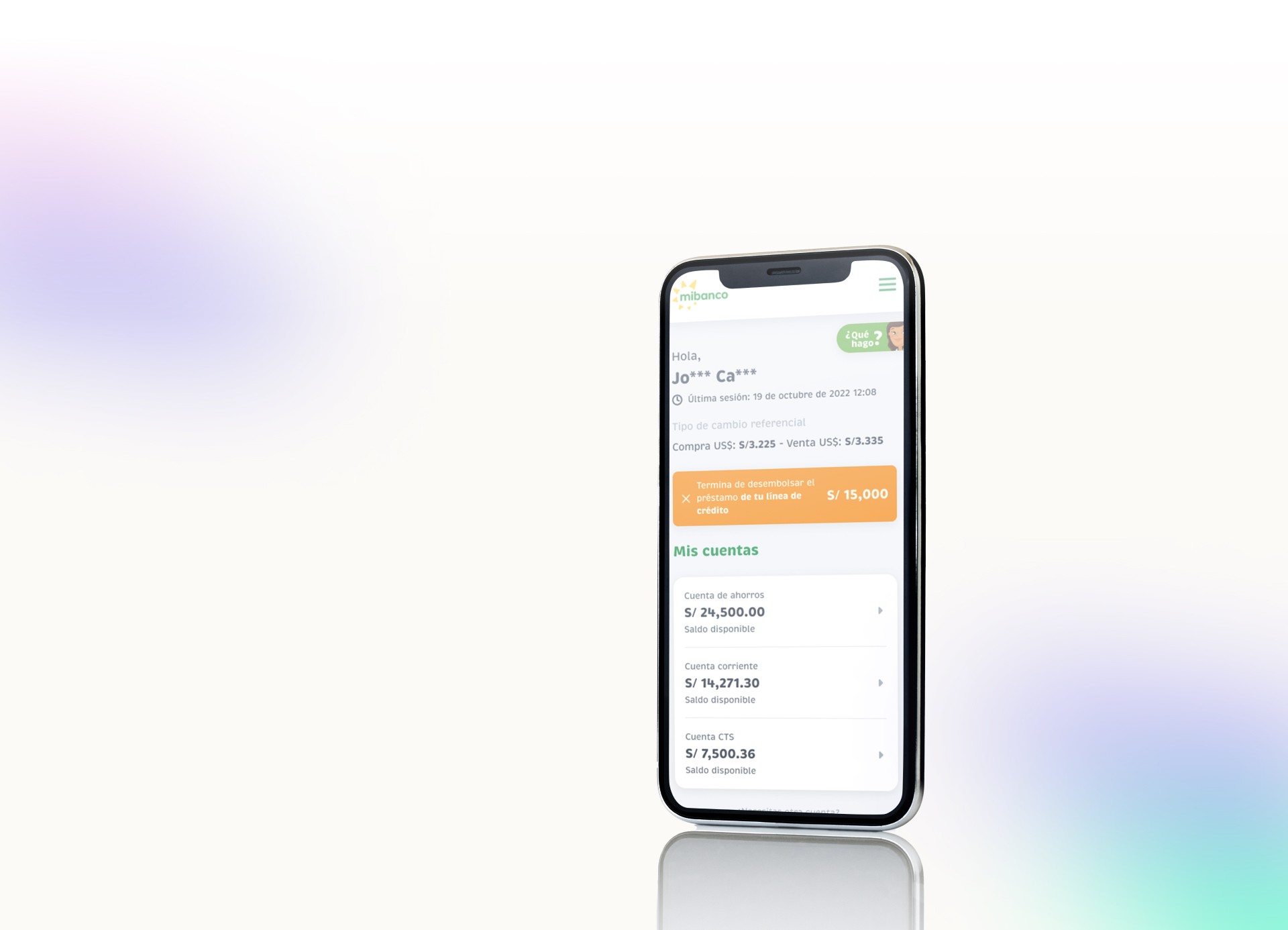

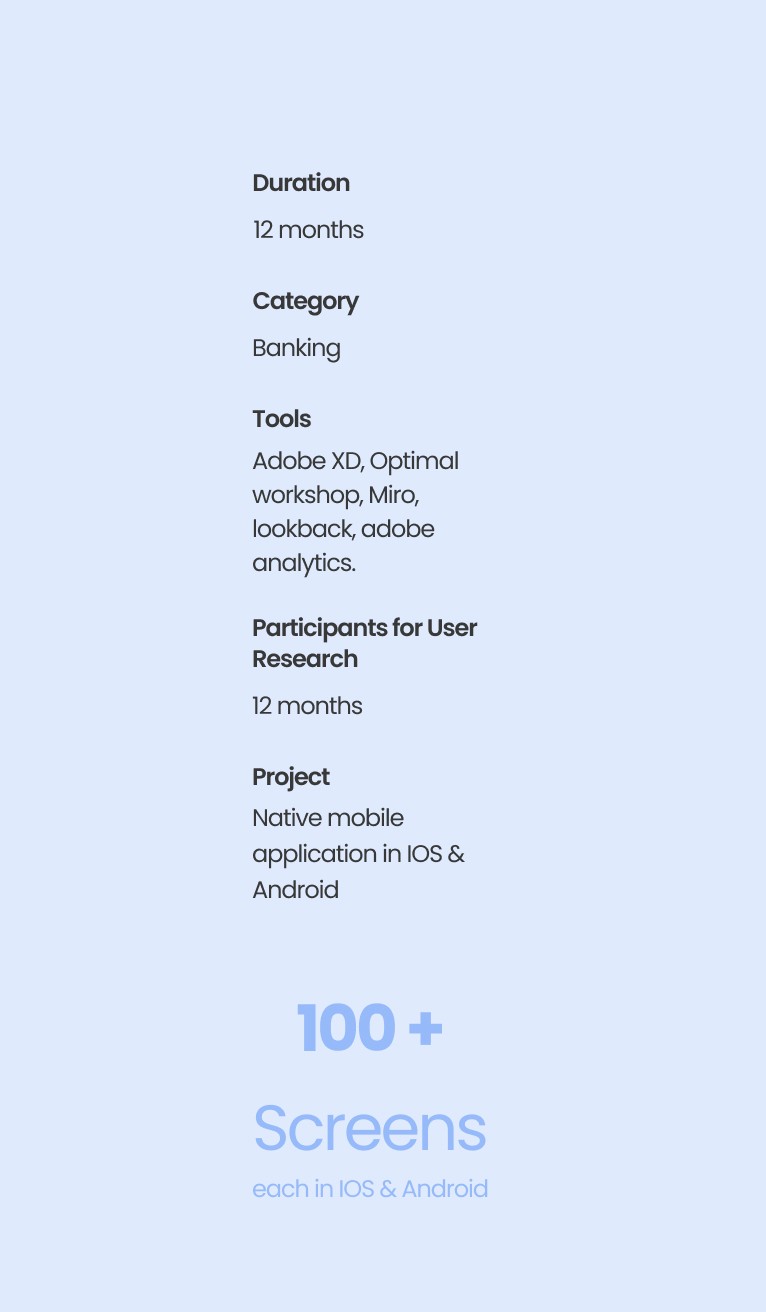

Project Overview

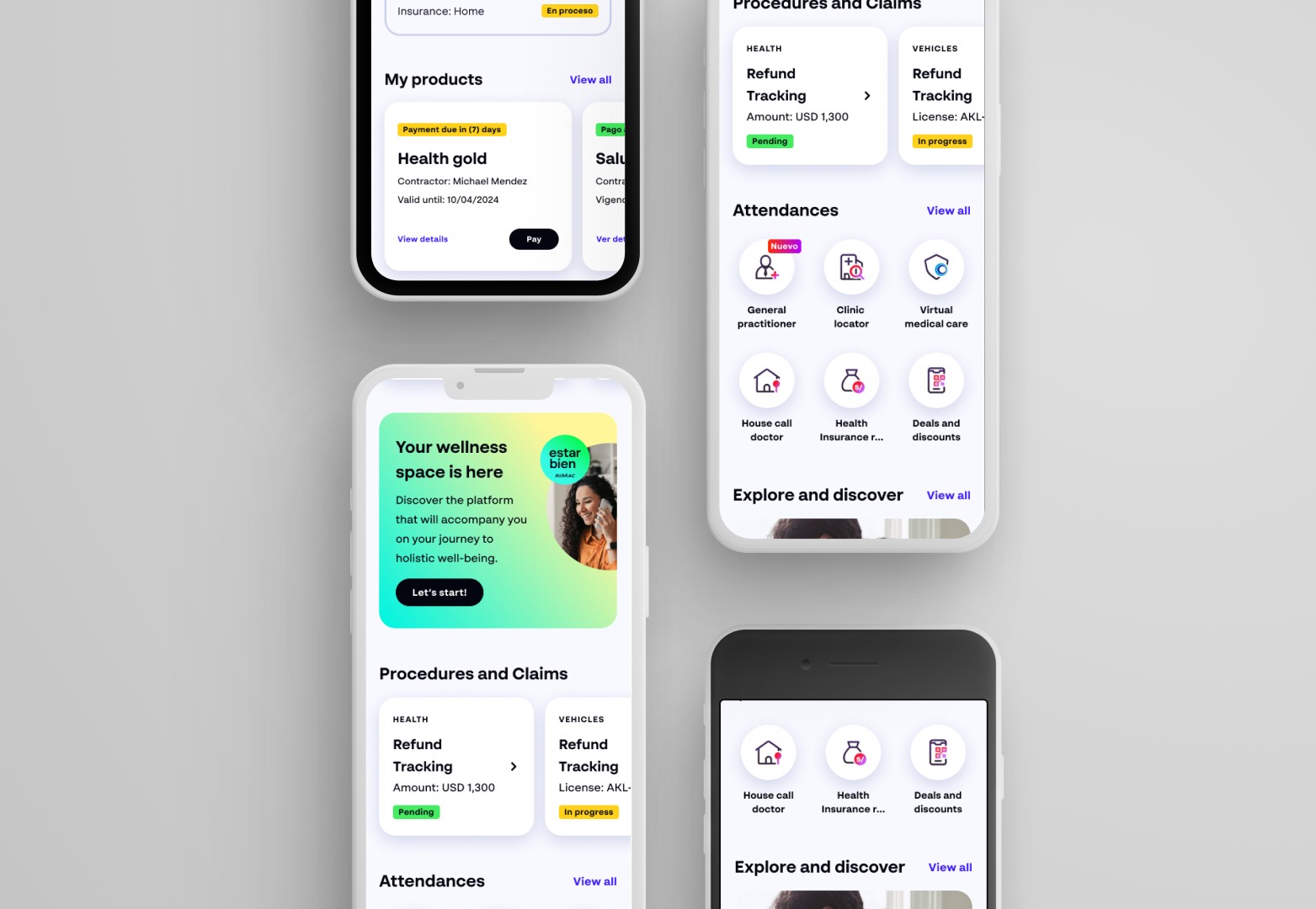

In the ever-evolving realm of financial dealings and functions, the project emerges as a shining example of ingenuity and practicality. Utilizing the design thinking approach and rigorously adhering to its phases, I've crafted and refined a fluid transactional environment.

Within this structure, I seize the chance to present a tactically integrated insurance solution. This project embodies our commitment to delivering all-inclusive financial answers that not only bolster our user but also defend their pursuits, representing a substantial stride towards a safer and thriving future.

My Role And Responsibilities

As a UX researcher, my role was to uncover user behaviors, needs, and motivations to make the app more intuitive and accessible for all users.

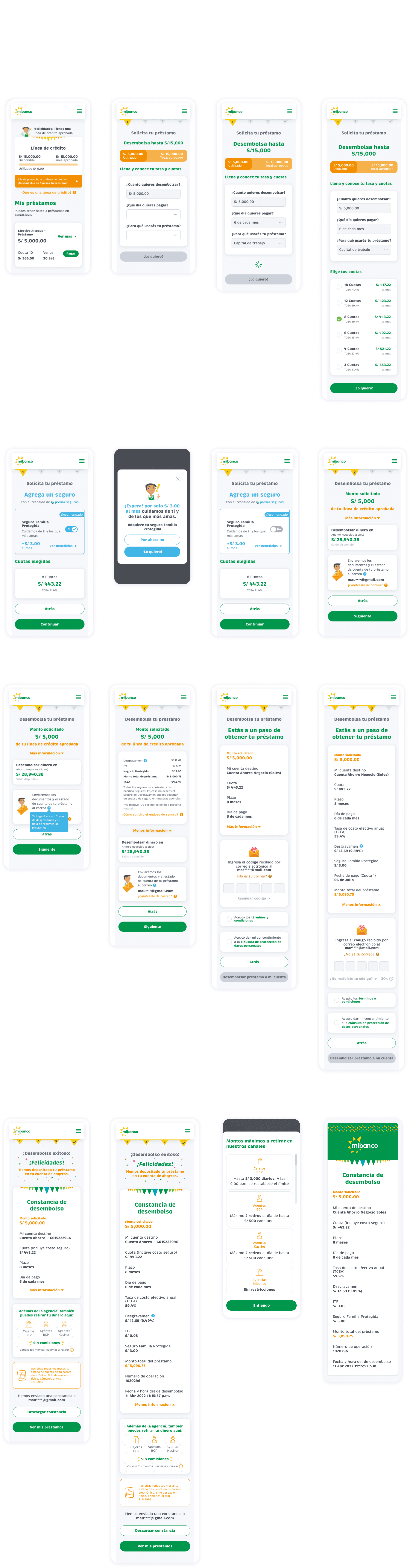

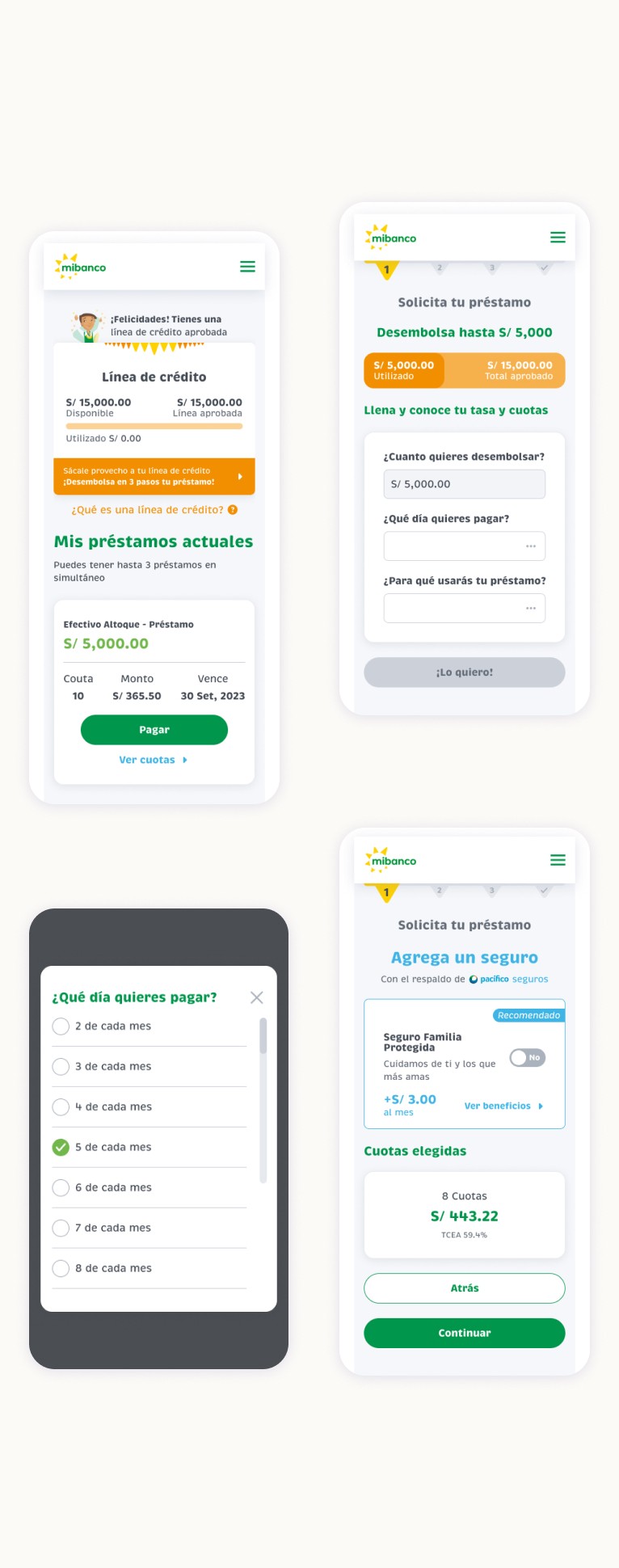

As a product designer, my role was to investigate user experience design requirements, develop and conceptualize a comprehensive UI/UX design strategy for the app, produce high-quality UX design solutions, design UI, and testing UI elements.

Problem Statement

How to seamlessly integrate the sale of insurance products within the bank's app without disrupting the transactional flow, such as loan applications.

Kick Off

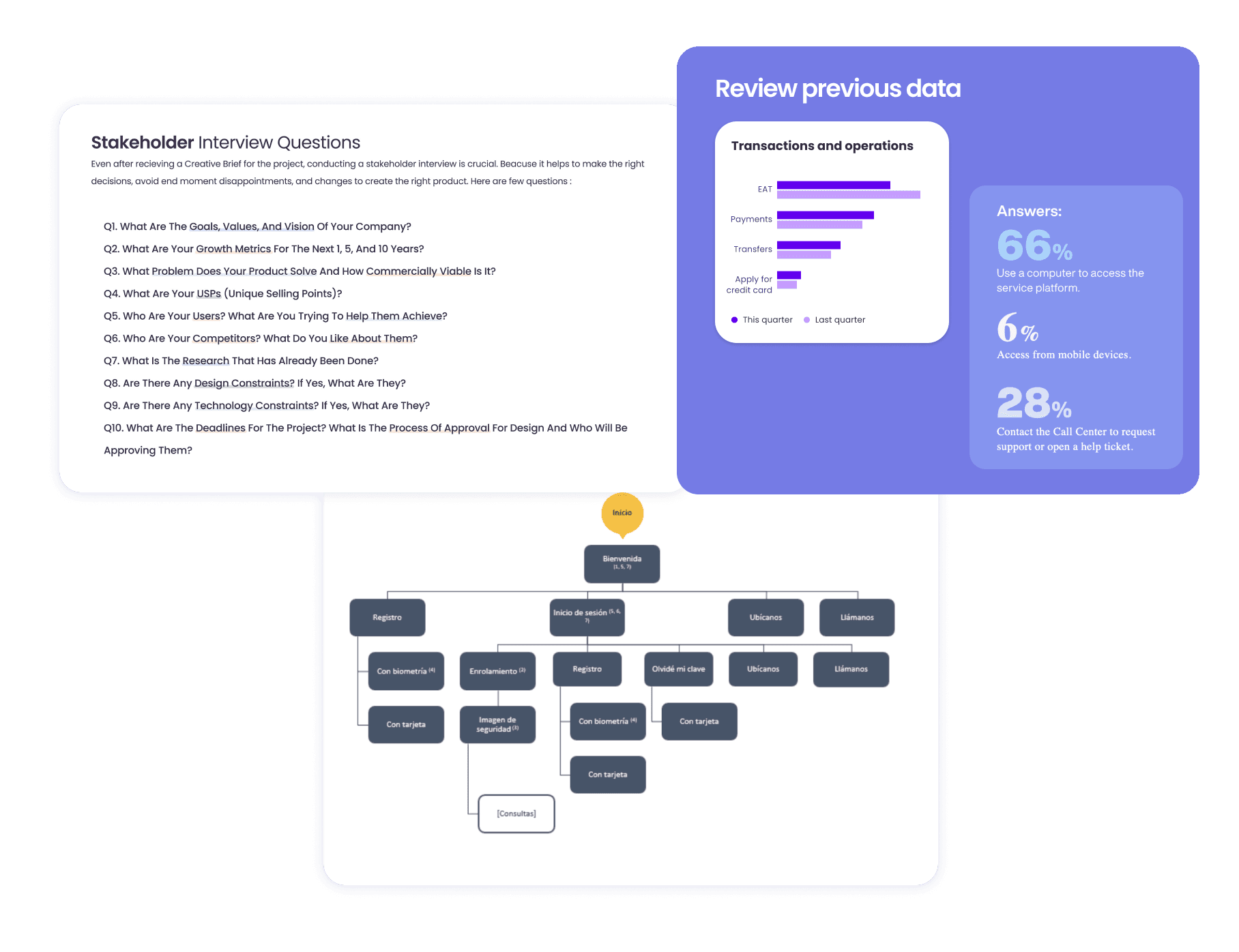

At first, I faced a landscape with limited information, where the company's goal was to elevate the user experience and expand its insurance product offerings. First, I devised a strategic roadmap with deadlines, meticulously organizing many tasks. This included gathering critical insights, heuristically evaluating the app, and conducting an exhaustive review of previous desk research.

My initial step was to comprehensively understand the stakeholders' objectives for the portal's redesign.

Subsequently, I subjected their ideas to rigorous validation against the genuine needs of our customers.

Finally, I embarked on crafting a product that harmonized with the company's goals while effectively addressing the pain points experienced by our valued customers.

Exploration And Discover

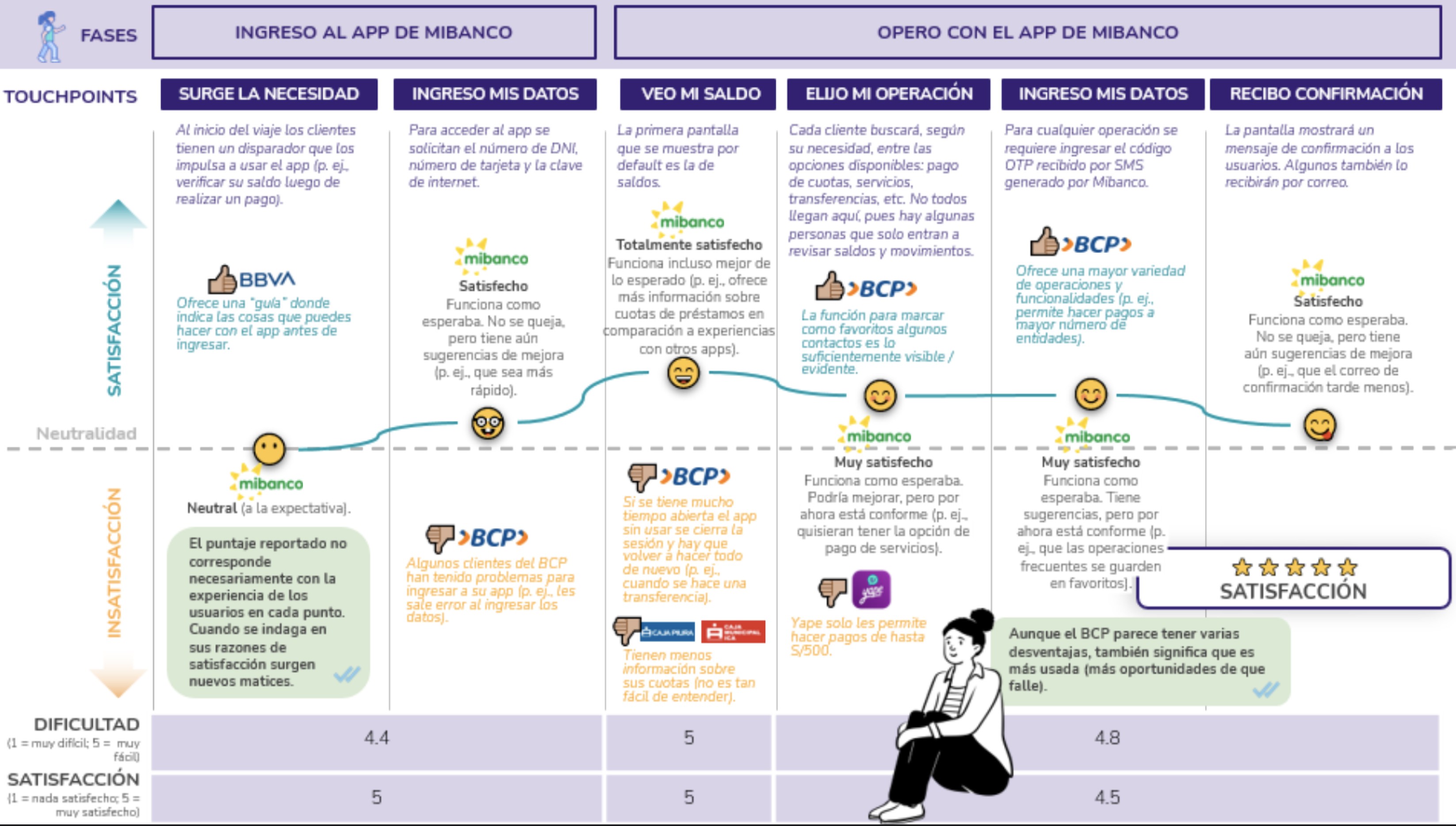

I immersed myself in a user-centric quest to unearth the needs and pains within the transactional flows where the integration of insurance products was imminent. I conducted surveys and observed real-world interactions to gain invaluable insights into user behaviors, desires, and pain points.

Employing a variety of human-centered design research methods, I uncovered hidden nuances that would have otherwise gone unnoticed. This deep dive allowed me to develop a comprehensive understanding of the user journey, their motivations, and the challenges they faced, providing a solid foundation which I could design innovative solutions that would enhance their experience and alleviate their pain points.

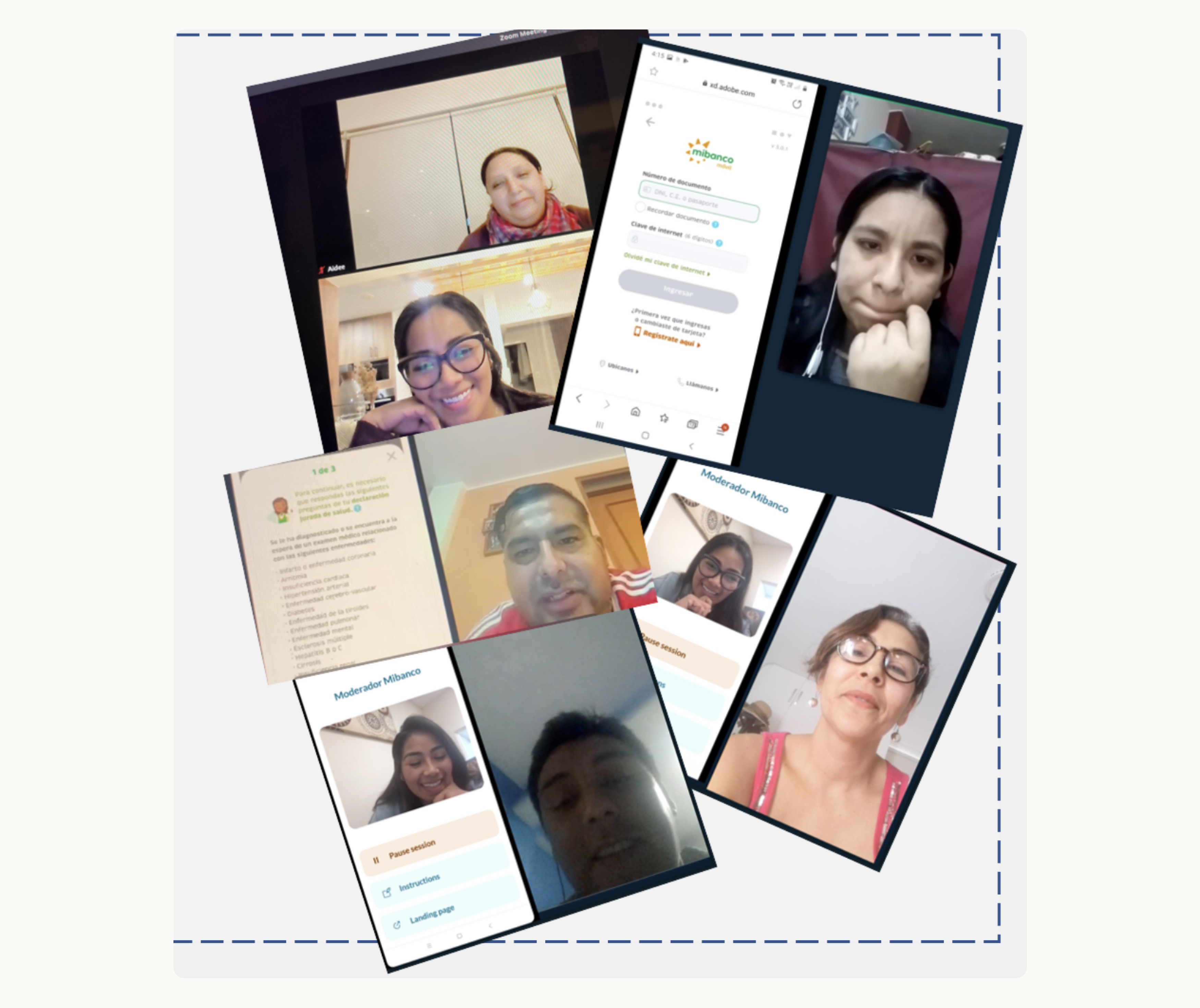

During this phase, we conducted remote interviews to gain valuable user insights and identified key touchpoints and pain points in the customer journey. With a focus on ideation, we brainstormed 'how might we questions to kickstart the process of devising innovative solutions that would effectively address these pain points.

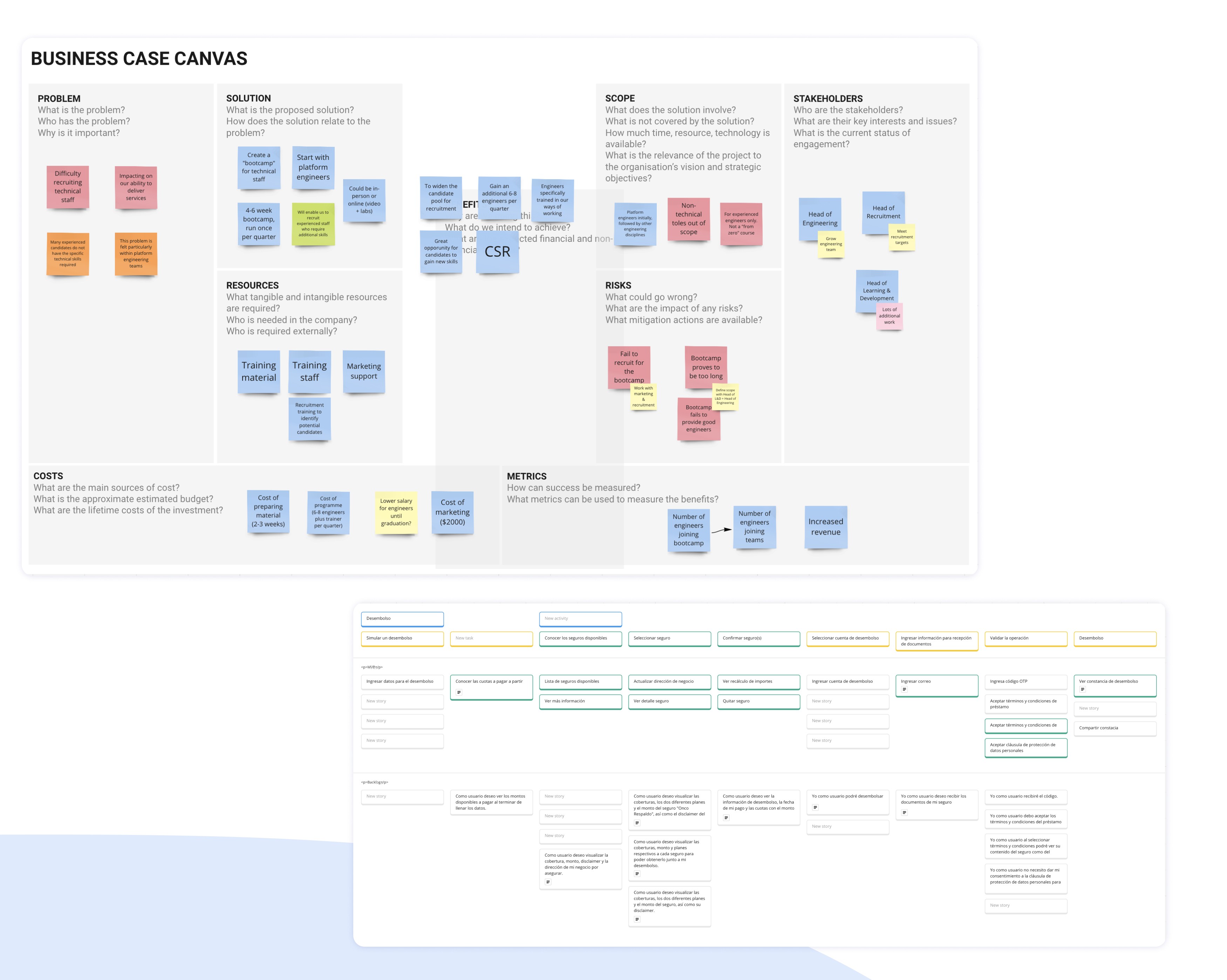

Ideate And Prioritize

This approach accelerated my progress and propelled me closer to achieving our team's objectives.

It facilitated the effective allocation of resources, concentrated on high-impact concepts, and helped me uncover 'quick wins'.

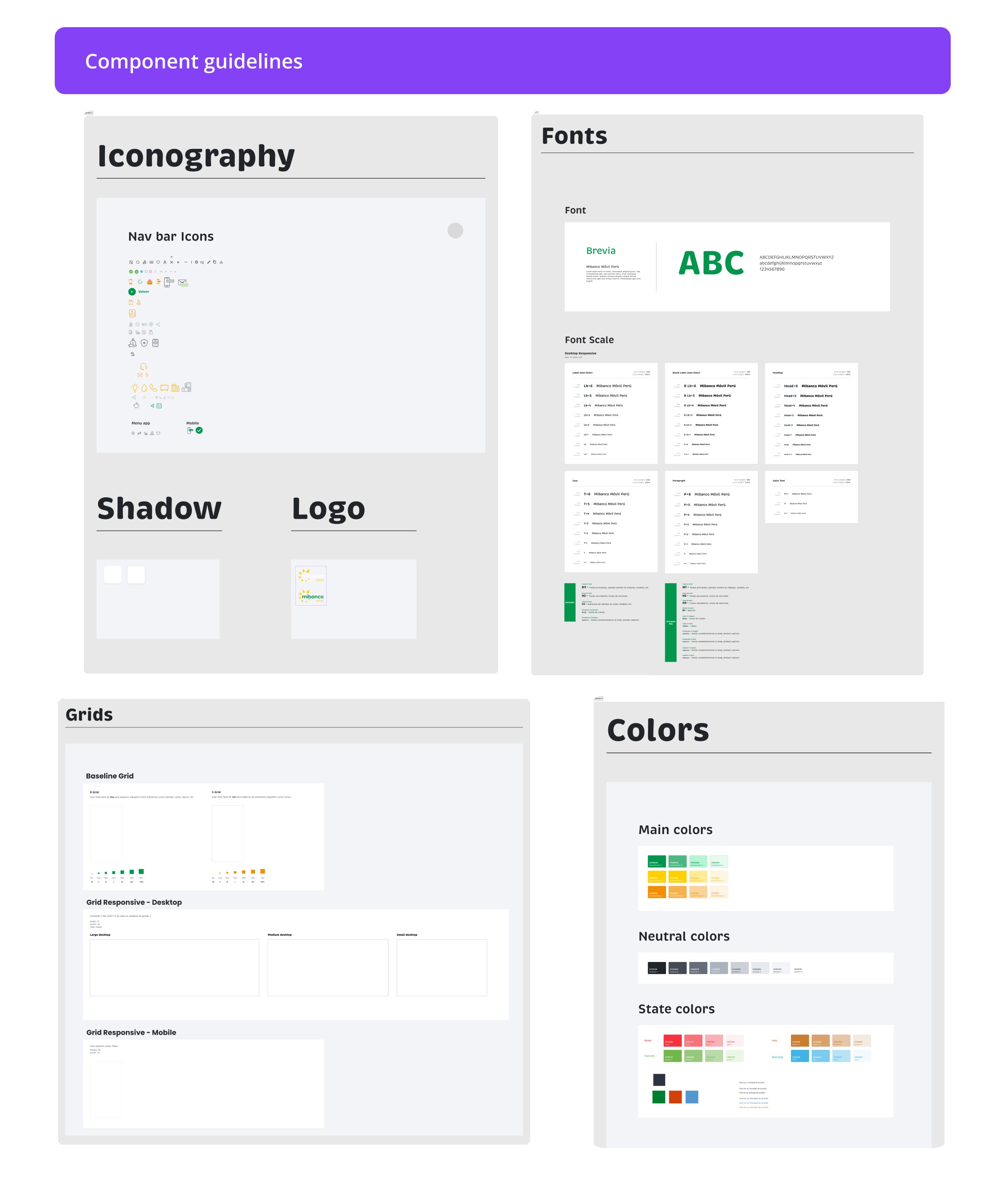

Visual Guidelines

For this specific project, I needed to develop components, guidelines, visual elements, tokens and establish a structure for another project which was building a design system for the client's many products.

Testing And Refine

Upon completing the prototypes, we conducted validation sessions with 5 users, crafting a script with the most pertinent questions to define solutions and refine the prototypes.

Subsequently, we prepared for the handoff to the development phase, conducting a thorough review with various stakeholders to ensure alignment and a smooth transition.

Ship sites with style.

Get Started

Learn More

Other Projects

Rimac Insurance

View case study

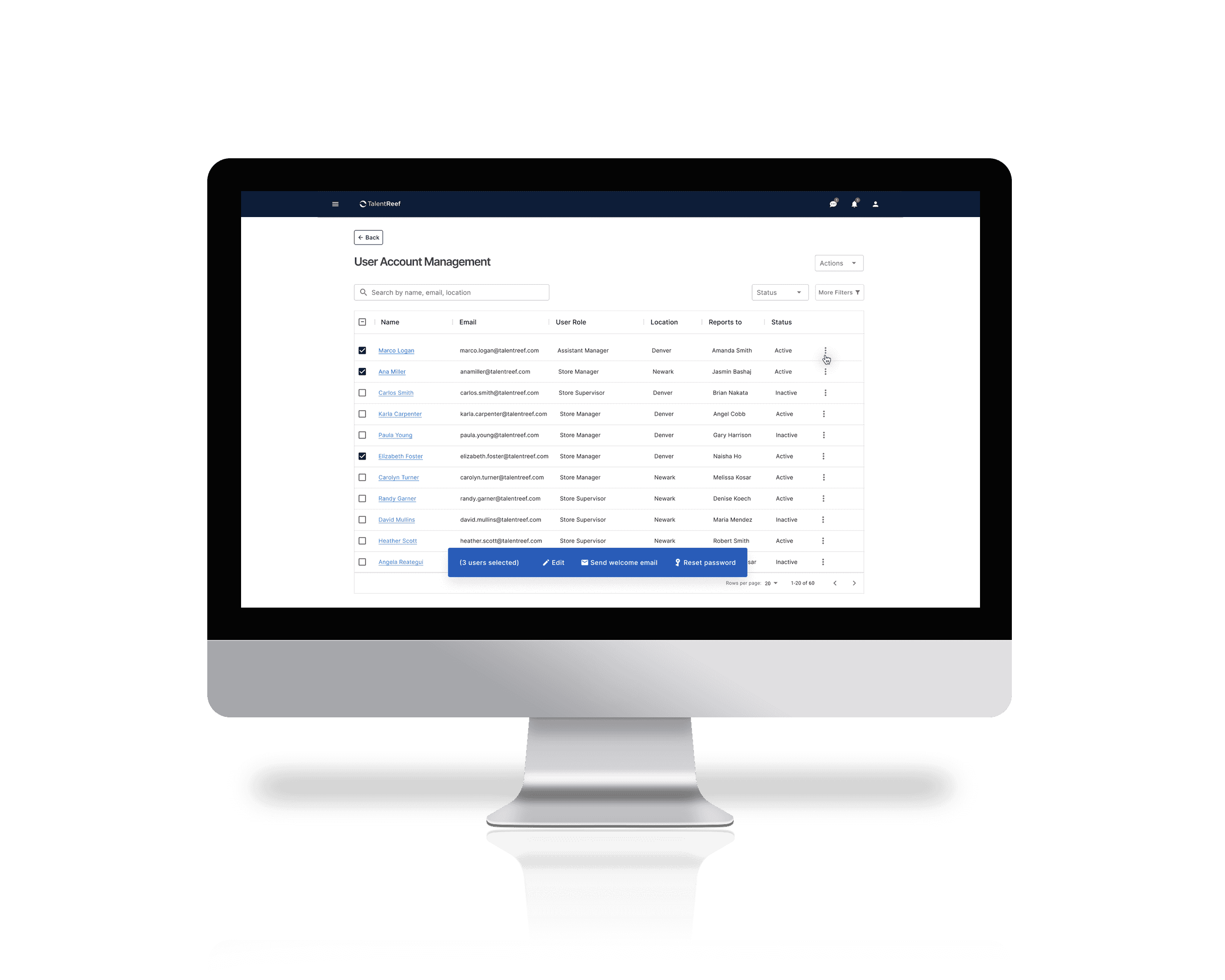

Talent Reef Software

View case study

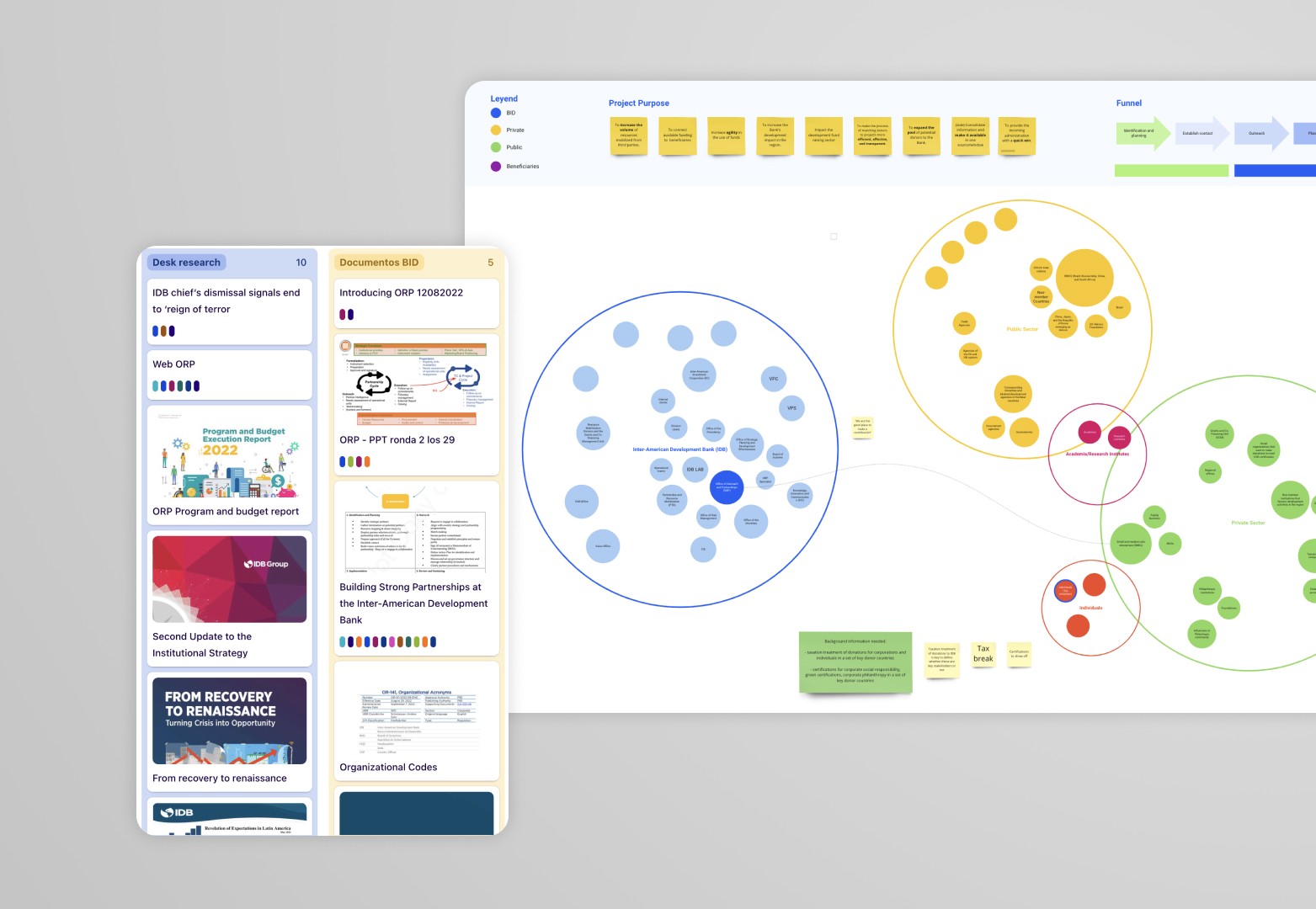

Inter-American Bank

View case study

Designed by Ingrid Valdera using Framer

Last updated November 2023.